Contents:

Using tech-based tools that organize information can save tons of time, and mitigate the risk of human error in these important processes. Because blockchain enables users to access ledgers in real time, as well as create smart contracts and record transactions, it’s no surprise the system is catching the notice of accountants. In fact, many accounting firms already implement blockchain, including the Big Four — EY, PwC, Deloitte, and KPMG — according to Accounting Today.

Changes in 2024 CPA Exam Put Technology Front and Center – CPAPracticeAdvisor.com

Changes in 2024 CPA Exam Put Technology Front and Center.

Posted: Tue, 07 Mar 2023 08:00:00 GMT [source]

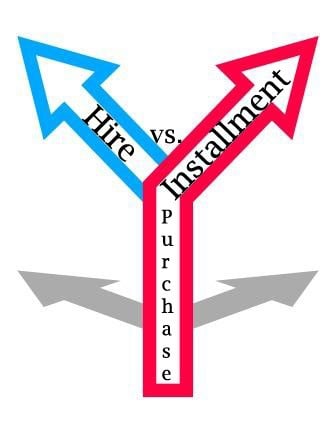

Ellen Wengert, a former present value of an annuity table processor at an Australian insurance firm, learned this lesson four years ago, when she arrived at work one day to find a bot-builder sitting in her seat. A common example of so-so automation is the grocery store self-checkout machine. These machines don’t cause customers to buy more groceries, or help them shop significantly faster — they simply allow store owners to staff slightly fewer employees on a shift. This simple, substitutive kind of automation, Mr. Acemoglu and Mr. Restrepo wrote, threatens not just individual workers, but the economy as a whole. But those concerns matter less now, with millions of people already out of work and many businesses struggling to stay afloat.

Will accounting become automated?

As Forbes explains, larger firms using RPA AI integration have “increased efficiency and higher-level services,” compared with smaller, non-AI competitors. The accounting industry is rapidly evolving with the rise of technology. For example, “automation, minibots, machine learning, and adaptive intelligence are becoming part of the finance team at lightning speed” at consulting firm Accenture, as noted in Forbes. And human accountants and CPAs don’t have to worry about being replaced by accounting software and AI technology.

Automating Expenses et Reimbursments – Accountants are often left with the time-consuming, tedious and error-prone task of manually entering and reconciling expenses. With automation, this isn’t an issue since everything gets entered automatically based on your preferences set up in the software. Accountants also use it to automatically generate receipts when someone submits an expense report through QuickBooks Online or Xero.

Uncover anomalies and changes to business processes

Hann worked with Charles Ham and MaryJane Rabier of Washington University in St. Louis, and Wenfeng Wang of City University of Hong Kong. Spurred by other research on how technology has affected the labor market, the researchers look specifically at how the accounting industry has evolved. Even on the employee front, those well-adapted to AI are paid above the median salaries of similar traditional profiles, particularly freshers, technocrats, residents of high-tech cities, etc. But for mid-career professionals and technology averse, the opportunities are reducing at an increasing rate. AI empowers businesses to understand and respond to fast-changing business by making ready data available and simulating business environments for testing and evaluating variables before hitting ground zero. One such example is a financial planning & analytics app called Jirav which helps automate the financial modeling process.

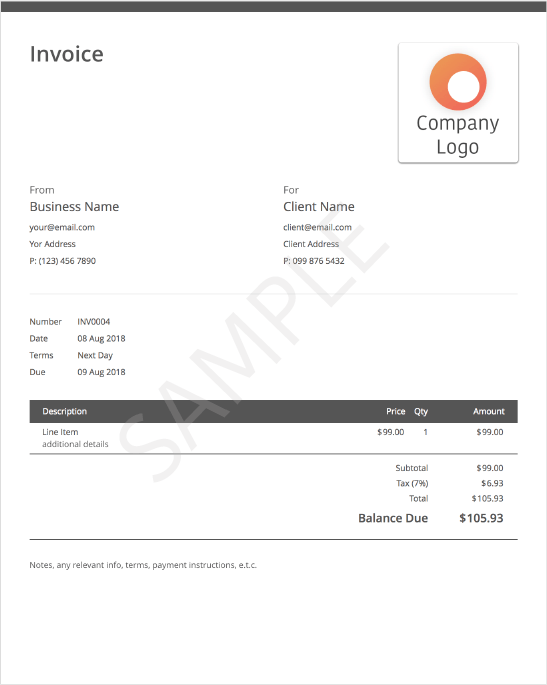

At this time, there is a huge gap between small businesses and large enterprises concerning invoice management. Efficiency in this task contributes to the company’s overall productivity. In the future, businesses are still going to need accountants to scale cost-effectively and cost-efficiently. Besides that, business owners will have more control over which individuals in their business or back office can access specific financial information. This capability helps minimize the risk of certain ledgers being exposed to unauthorized employees. The need to do data configuration manually may also be automated in the future.

Best Accounting Software for Restaurants of 2023 – Investopedia

Best Accounting Software for Restaurants of 2023.

Posted: Mon, 19 Sep 2022 23:45:23 GMT [source]

The accounting software can generate reports that cover all the bases required to fulfill auditing requirements. Additionally, the records are maintained such that a quick glance gives the auditor detailed information. Just as paper replaced stone, and spreadsheets replaced paper – switching to accounting automation tools is simply a matter of keeping up with the times. Aside from being extremely time-saving, cost-saving, and efficient, it is also a chance for your team to focus on the bigger picture and become detail-oriented.

“Automation is more politically acceptable now,” said Raul Vega, the chief executive of Auxis, a firm that helps companies automate their operations. The trend — quietly building for years, but accelerating to warp speed since the pandemic — goes by the sleepy moniker “robotic process automation.” And it is transforming workplaces at a pace that few outsiders appreciate. Nearly 8 in 10 corporate executives surveyed by Deloitte last year said they had implemented some form of R.P.A. Another 16 percent said they planned to do so within three years.

Grown your business with Envoice

This could mean setting the correct policies that fulfill this framework, as well as choosing the correct people who can efficiently handle the software and approve in time. If your focus is on compliance, then MYOB is possibly your best bet. Its time-saving features make it beloved to those who are looking for acute financial insights and compliance-friendly reporting.

- Use our software evaluation template to decide which accounts receivable software you must invest in.

- Having full visibility into your accounting processes creates transparency.

- Accounting and bookkeeping platforms like Quickbooks, Oracle, FreshBooks, Zoho Books, and many others are used daily in businesses of every size.

- Activities such as setting a budget and purchasing the necessities may trick people into thinking that bookkeeping is easy to do early on.

- From physical robotic processes to data recording to decision-making systems and predictive analysis, automation is evolving in its capabilities and application.

- They encourage better time management and allow all staff members to monitor a project’s progress, while flagging any issues.

Accountants use workflow automation tools to save time and improve their efficiency, so they can spend more time on high-value activities such as performing audits and analyzing financial data. In fact, ensuring your practice makes the most out of automation and it’s in line with new, exciting technologies also help with retention. Young accountants are not willing to spend their time with manual data entry or other uninspiring tasks before they can move on to more interesting work. This generation is digital, and know how to use technology to automate what can be automated, giving them the time to learn and get involved in other areas that’s more valuable for the firm and its clients.

The danger of so-so automation

Automating Invoices – Invoice processing is a critical part of the accounting workflow. Accounting firms must send out invoices in a timely manner to ensure their clients receive payment on time. Many accounting firms use automated systems to send out invoices, which helps them keep track of outstanding balances and manage cash flow more effectively. While news stories like this one like to pit artificial intelligence and accountants against each other, the future isn’t either AI or human accountants. Like other automation technologies (e.g., cloud computing), AI will change the focus of accountants’ roles.

For added safety, you can even encrypt your data to ward off additional security threats like data breaches and cyberattacks. Manual accounting presents a number of challenges to accuracy, productivity, and efficiency. Microsoft Dynamics is similar in its functionality to NetSuite, although the user interface is vastly different.

College graduates will have a hard time getting into the accounting field since management accounting positions will require 5-10 years of accounting experience. They won’t be able to get experience if all accounting outside of management is automated. While they might require some mathematical skill, this can easily be automated, even without machine learning. Most people misunderstand the job of an accountant to be a book-keeper. The book-keeper has long been eliminated and the accountant is a finance position involving professional judgement that is not yet programmable let alone being left to low level artificial intelligence. In fact, all the major accounting software that are automating away manpower – none are created by Big 4.

Businesses can generate custom reports on a range of data to glean insights — presenting a clear picture of the business to the finance team and driving meaningful strategy. For example, you can quickly generate a table, fix the appropriate parameters to include only the relevant data for your query, then the reports are generated automatically. Payroll is one of the most repetitive and time-consuming tasks to perform manually. Select a software that can automate parts of the process like time reporting, overtime tracking, and tax calculations.

However, access to clean, automated books creates an opportunity for businesses to get more out of their accounting firm. As transactional accounting is more democratized by low-cost software, companies need a higher level of financial service. Undoubtedly, the accountant of the future will need to be technologically savvy to evolve with the changing industry. Accounting professionals who wish to use blockchain will need to be familiar with relevant software programs, as well as how to set up information transfer for ledgers, contracts, and records.

ChatGPT: The 10 jobs most at risk of being replaced by AI – Business Insider

ChatGPT: The 10 jobs most at risk of being replaced by AI.

Posted: Sun, 09 Apr 2023 07:00:00 GMT [source]

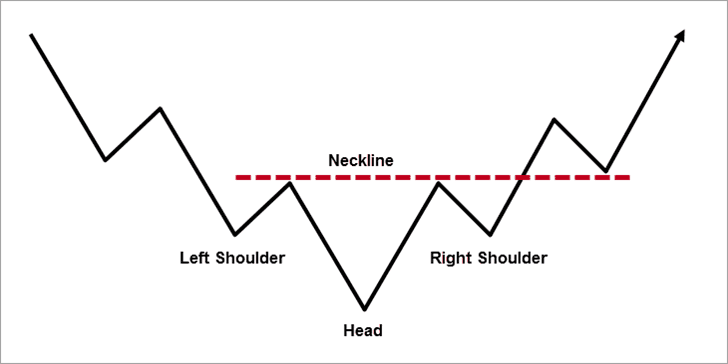

Avrohom Gotteheil has some interesting thoughts on how to leverage automation in the right places. The US seems to be more advanced than most in this area, but each jurisdiction has at least a few options that exist to automate tax planning. TaxPlanIQ and TaxMasterNetwork provide two similar tools as well which I know are quite popular. MindBridge has been helping to automate the work auditors have been doing for years by scanning 100% of the data, rather than just a sample, to spot potential issues.

(6)